The top 5 stocks to invest in are Amazon, Apple, Microsoft, Google, and Tesla. These stocks have strong potential for growth and are backed by solid financial performance.

Investing in stocks can be an effective way to grow your wealth over time. However, with countless options available in the market, choosing the right stocks to invest in can be a daunting task. When considering where to invest your hard-earned money, it’s crucial to conduct thorough research and carefully assess the potential risks and rewards.

The top 5 stocks mentioned above have established themselves as industry leaders, driving innovation and demonstrating consistent financial performance. By understanding the market trends and staying informed about the companies’ developments, investors can make well-informed decisions to maximize their returns. Whether you’re a novice or experienced investor, these top 5 stocks could be worthwhile additions to your investment portfolio.

Table of Contents

Identifying The Best Stocks

When it comes to identifying the best stocks for investment, thorough research and analysis are crucial. Understanding the market trends, evaluating company financials, and identifying growth potential are essential steps in making informed investment decisions. Let’s delve into the key elements of identifying the best stocks that can potentially maximize your investment returns.

Market Research And Analysis

Conducting comprehensive market research and analysis is fundamental in identifying the top stocks for investment. By analyzing market dynamics, trends, and industry performance, investors can gain valuable insights into the potential growth of a company.

Furthermore, evaluating the competitive landscape and assessing the market positioning of a company can aid in identifying stocks with strong growth prospects.

Evaluating Company Financials

Analyzing the financial statements of a company is critical in assessing its financial health and performance. Evaluating key financial metrics, such as revenue growth, profit margins, and cash flow, provides a comprehensive understanding of a company’s financial strength.

Moreover, analyzing key performance indicators, such as return on equity and debt-to-equity ratio, helps in assessing the long-term sustainability and profitability of a company.

Credit: www.fool.com

Diversification And Risk Management

When it comes to investments, diversification and risk management are crucial aspects to consider. By spreading your investments across industries and assessing risk levels, you can effectively manage and minimize potential risks, ultimately optimizing your portfolio’s performance.

Spreading Investments Across Industries

Spreading your investments across various industries can help mitigate the impact of adverse events within a single sector. By allocating funds to diverse industries such as technology, healthcare, consumer goods, and energy, you can reduce the impact of industry-specific downturns on your overall portfolio. This approach ensures that the performance of one sector does not overly influence your investment outcomes, contributing to a more stable and balanced investment portfolio.

Assessing Risk Levels

Evaluating the risk levels of potential investments is vital in managing and reducing risks. By conducting thorough analysis and due diligence, you can identify and assess the potential risks associated with each investment opportunity. This enables you to make informed decisions based on risk tolerance and expected returns, thereby optimizing your portfolio in alignment with your financial goals.

Understanding Growth Potential

When it comes to investing in stocks, understanding the growth potential of a company is essential. By identifying industries with high growth and analyzing company expansion strategies, investors can make informed decisions. In this article, we will discuss these two key aspects of understanding growth potential.

Identifying Industries With High Growth

Before investing, it’s important to identify industries that offer high growth potential. By focusing on industries that are in the growth phase, investors can maximize their returns. Here are a few ways to identify such industries:

- Monitor market trends and emerging sectors.

- Research industry reports and forecasts.

- Consider the demand for products or services.

- Stay updated with technological advancements.

By keeping a close eye on these factors, investors can identify industries poised for growth and select stocks accordingly.

Analyzing Company Expansion Strategies

Once you have identified industries with high growth potential, the next step is to analyze the expansion strategies of individual companies. This will help you determine which companies are well-positioned to capitalize on the growth opportunities within their industry.

Here are a few key factors to consider when analyzing company expansion strategies:

- Research on the company’s past performance and track record of growth.

- Assess the company’s competitive advantage and market positioning.

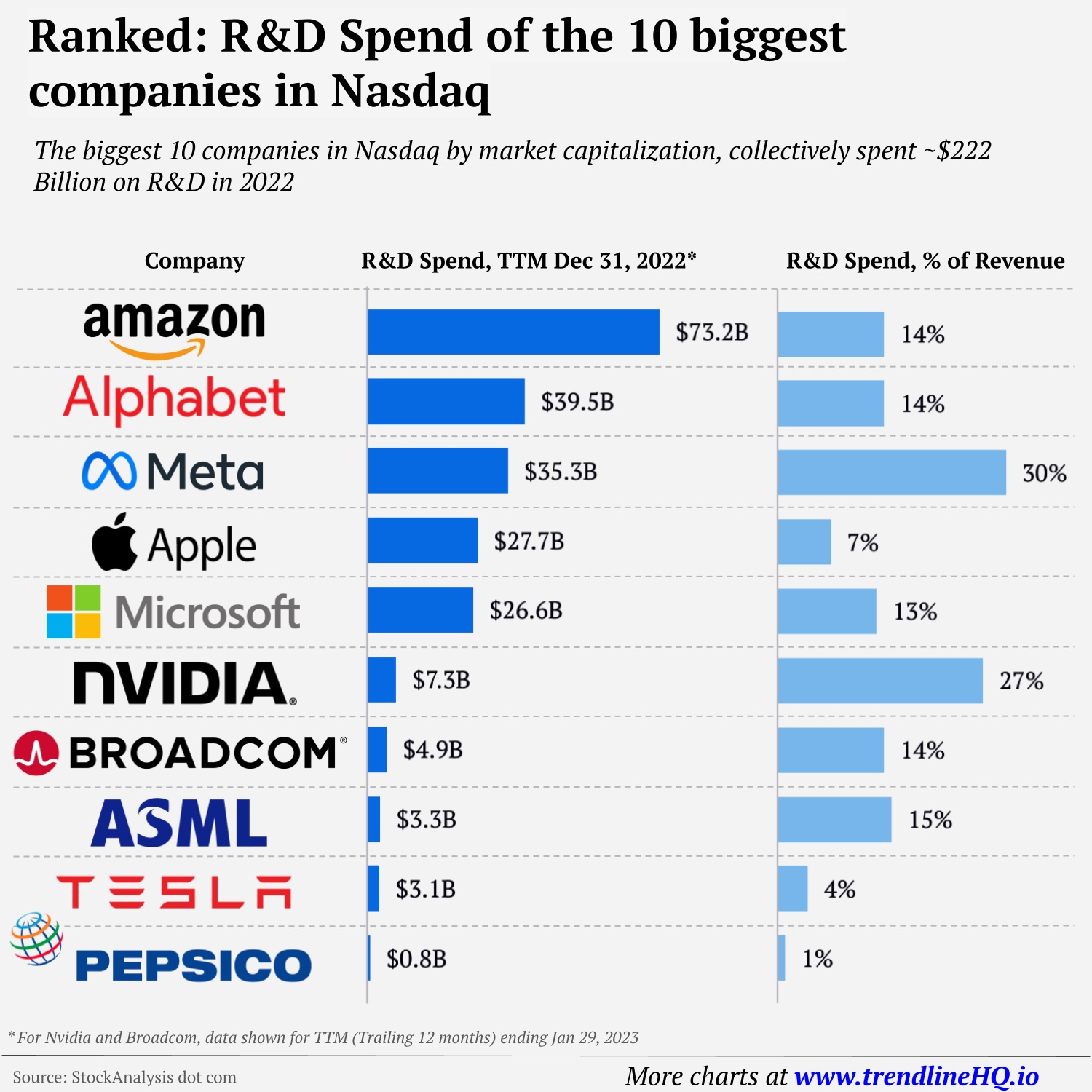

- Review their plans for research and development, product innovation, and geographical expansion.

- Analyze their financial statements and evaluate their ability to finance future growth.

By conducting a thorough analysis of these factors, investors can gain insights into a company’s growth potential and make more informed investment decisions.

Credit: www.visualcapitalist.com

Long-term Vs. Short-term Investment Strategies

When it comes to investing in stocks, it’s crucial to develop strategies that align with your financial goals. Long-term and short-term investment strategies offer distinct advantages and considerations. Understanding these approaches can help you make informed decisions and maximize your gains. In this article, we will explore the key considerations for long-term investments and the importance of timing and market trends for short-term gains.

Considerations For Long-term Investments

Long-term investments are aimed at generating consistent growth over an extended period, typically spanning several years. These investments are known for their stability and ability to compound returns over time. Here are some essential factors to consider when adopting a long-term investment strategy:

- Research and diversification: Before investing in stocks for the long term, conduct thorough research on the companies you are considering. Diversify your portfolio by investing in a mix of industries to minimize risk.

- Investment horizon: Determine the length of time you are willing to hold your investments. The longer your investment horizon, the more you can benefit from the power of compounding.

- Company fundamentals: Focus on companies with strong fundamentals, including stable earnings, low debt, and a track record of steady growth. Look for businesses with a competitive advantage and solid management teams.

- Patience and discipline: Long-term investments require patience and discipline. Resist the urge to make frequent changes to your portfolio based on short-term market fluctuations.

Timing And Market Trends For Short-term Gains

Short-term investment strategies aim to capitalize on market trends and take advantage of price fluctuations within a shorter timeframe. These strategies require careful attention to timing and market conditions. Here are some factors to consider when pursuing short-term gains:

- Technical analysis: Use technical indicators and chart patterns to identify short-term trends in stock prices. Technical analysis helps investors make decisions based on price patterns, volume, and other market variables.

- Market volatility: Short-term investment strategies thrive on market volatility. High volatility can present opportunities for quick gains, but it also comes with increased risk.

- News and events: Stay informed about corporate announcements, economic data releases, and other news events that can impact stock prices. React quickly to news that may affect short-term market trends.

- Stop-loss orders: When pursuing short-term gains, set stop-loss orders to limit potential losses. These orders automatically sell a stock if it reaches a predetermined price, protecting your investment against unexpected downturns.

Monitoring And Reviewing Performance

Monitoring and reviewing the performance of your investments is crucial for maximizing returns and minimizing risks. By regularly evaluating the progress of your portfolio, you can identify any underperforming stocks and make informed decisions to adjust your investment strategy. In this section, we will discuss the steps you can take to establish effective monitoring techniques and how to reassess your investment decisions.

Establishing Monitoring Techniques

Establishing effective monitoring techniques is essential to keep track of how your investments are performing. Here are some key steps to consider:

- Set Clear and Measurable Goals: Clearly define your investment objectives and establish measurable benchmarks to track the progress of your stocks.

- Regularly Monitor Market Conditions: Keep a close eye on market trends, industry news, and economic indicators that could impact the performance of your stocks.

- Utilize Financial Metrics: Use financial ratios and metrics such as price-to-earnings ratio (P/E ratio), return on investment (ROI), and compound annual growth rate (CAGR) to assess the financial health and growth potential of your investments.

Reassessing Investment Decisions

Reassessing your investment decisions is necessary to ensure your portfolio remains aligned with your goals and objectives. Here’s what you need to consider:

- Regular Portfolio Review: Conduct a periodic review of your portfolio to evaluate the performance of individual stocks and their contribution to the overall portfolio.

- Stay Informed: Stay updated on industry trends and news to identify any factors that may influence the prospects of your investments.

- Take Calculated Risks: Assess the risk-reward ratio of your investments to determine if any adjustments need to be made to optimize your returns.

By regularly monitoring and reviewing the performance of your stocks, you can make well-informed decisions to maximize your investment outcomes.

Credit: www.fool.com

Frequently Asked Questions On Top 5 Stocks To Invest

What Are The Top Factors To Consider When Investing In Stocks?

Investors should consider a company’s financial health, industry trends, management team, growth potential, and past performance to make informed decisions about stock investments.

How Can I Determine If A Stock Is A Good Investment?

Evaluate the company’s financial statements, analyze the industry’s growth prospects, assess the company’s competitive advantage, and consider the stock’s valuation to determine if it aligns with your investment goals.

What Are The Potential Risks Of Investing In Stocks?

Stock investments come with risks such as market volatility, economic downturns, industry-specific risks, and company-specific risks. It’s important to diversify your portfolio and stay informed to mitigate potential losses.

Conclusion

To sum up, these top 5 stocks have shown great potential for investment. With diverse sectors and strong market performance, they present exciting opportunities for investors. Keep an eye on their financial performance, market trends, and overall growth potential. Remember, investing in stocks requires thorough research and careful consideration of your financial goals.

Stay informed, stay diligent, and make wise investment decisions to maximize your returns. Happy investing!