Looking to enhance your investment strategies? Here are the top 10 investment tricks to help you maximize your returns and minimize risks.

From diversifying your portfolio to staying informed about market trends, these strategies can help you make the most of your investments. Whether you’re a novice investor or an experienced one, these tips can serve as valuable tools for navigating the complex world of finance and investments.

By employing these tricks, you can work towards building a strong and resilient investment portfolio that aligns with your financial goals and risk tolerance. So, let’s dive in and explore these top 10 investment tricks to boost your investment success.

Table of Contents

1. Diversify Your Portfolio

When it comes to smart investing, one of the top tricks is to diversify your portfolio. Diversification is a crucial strategy that can help reduce risk and maximize returns. By spreading your investments across various assets and industries, you can protect your portfolio from the volatility of any single investment. Here are some effective ways to diversify your portfolio:

1.1 Invest In Different Asset Classes

Diversifying your portfolio involves investing in different asset classes, such as stocks, bonds, real estate, and commodities. Each asset class responds differently to market conditions, so having a mix can help mitigate risk and potentially improve overall returns.

1.2 Spread Your Investments Across Industries

Another crucial aspect of diversification is to spread your investments across different industries. By investing in companies from various sectors such as technology, healthcare, consumer goods, and energy, you can reduce the impact of industry-specific risks on your portfolio. This approach helps to balance the performance of your investments and lessen the impact of any downturn in a particular sector.

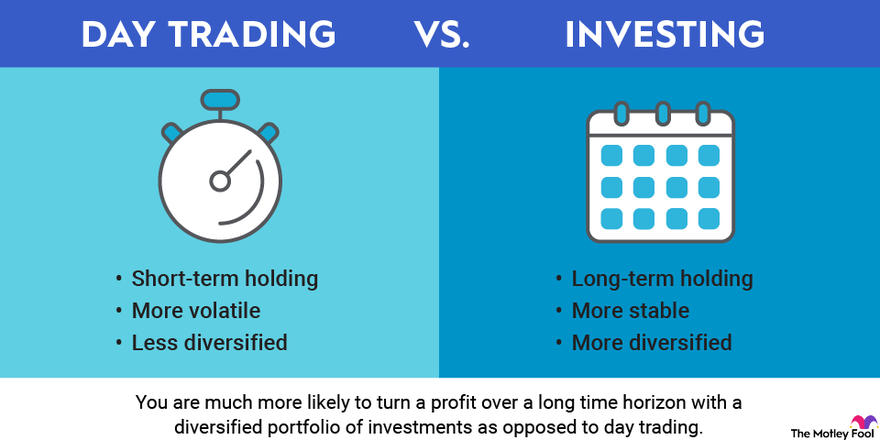

Credit: www.fool.com

2. Follow A Long-term Investment Strategy

When it comes to successful investing, following a long-term investment strategy is essential. While it may be tempting to act on short-term market fluctuations, embracing a long-term approach can lead to more stable and sustained growth for your investments. Here are some key tips to help you stay focused on your long-term investment strategy.

2.1 Don’t Get Distracted By Short-term Market Fluctuations

It’s crucial to avoid being swayed by short-term market movements. Instead, focus on the big picture, and try to tune out the day-to-day noise of the market. Remember that short-term fluctuations are often just temporary blips, and they shouldn’t dictate your long-term investment decisions. By keeping a long-term perspective, you can stay steady and avoid making hasty decisions based on short-term market movements.

2.2 Embrace The Power Of Compounding

One of the most powerful tools for long-term investors is the concept of compounding. This involves reinvesting any investment returns back into the portfolio, allowing the returns to generate further gains. Over time, compounding can lead to exponential growth in your investment. Starting early and embracing the power of compounding can significantly enhance the value of your investments over the long term.

3. Research And Analyze Potential Investments

When it comes to making wise investment decisions, research and analysis are paramount. Successful investors understand the importance of thoroughly examining the potential investments before committing their hard-earned money. By conducting thorough fundamental analysis and staying updated with market trends and news, you can make informed investment choices that have the potential to yield significant returns.

3.1 Conduct Thorough Fundamental Analysis

Before investing in any asset, it is crucial to conduct a thorough fundamental analysis. This process involves evaluating various factors that can impact the value and profitability of the investment. By assessing the financial health, market position, and growth prospects of a company or the underlying assets of an investment vehicle, you can gain insights into its potential future performance.

Here are some key aspects to consider when conducting fundamental analysis:

- Examine the company’s financial statements, including its balance sheet, income statement, and cash flow statement.

- Investigate the management team’s track record and their ability to generate consistent profits.

- Assess the competitive landscape and the company’s position within the industry.

- Evaluate the growth potential of the market or industry the investment is exposed to.

- Consider any regulatory or legal factors that may affect the investment’s viability.

- Calculate key financial ratios, such as the price-to-earnings (P/E) ratio or return on investment (ROI), to determine if the investment is reasonably valued.

By thoroughly analyzing these factors, you can uncover potential risks and opportunities associated with the investment. This will help you make informed decisions and minimize the chances of making costly mistakes.

3.2 Stay Updated With Market Trends And News

To stay ahead in the investment game, it is crucial to stay updated with the latest market trends and news. The financial markets are dynamic and constantly influenced by a myriad of factors, including economic indicators, geopolitical events, and technological advancements. By keeping an eye on these developments, you can make timely adjustments to your investment strategy and capitalize on emerging trends.

Here are a few ways to stay on top of market trends and news:

- Follow reputable financial news sources and subscribe to newsletters or publications that provide insights into the market.

- Set up alerts for specific keywords or companies to receive timely updates.

- Monitor economic indicators, such as GDP growth rates, inflation, and interest rates, to gauge the overall health of the economy and identify potential investment opportunities.

- Attend industry conferences, webinars, or seminars to gain insights from experts and network with like-minded individuals.

By staying informed and aware of market trends and news, you can make strategic investment decisions that align with the ever-changing landscape. This will enable you to adapt quickly to market conditions and potentially enhance your investment returns.

Credit: www.bankrate.com

4. Take Advantage Of Tax-efficient Investment Options

When it comes to investing, finding ways to minimize tax obligations can significantly enhance your returns. By leveraging tax-efficient investment options, you can legally optimize your investments and better protect your hard-earned money. Here are two popular strategies that can help you maximize your tax advantages:

4.1 Invest In Tax-free Savings Accounts

One option to explore is to invest in tax-free savings accounts (TFSA). These accounts allow you to contribute a fixed amount annually, and any growth or income generated within the account is tax-free. Whether you invest in stocks, bonds, mutual funds, or even cash, TFSAs provide a fantastic opportunity to accumulate wealth over time while keeping the government’s hands out of your pockets.

Unlike traditional investment accounts, capital gains, dividends, and interest earned within a TFSA are not taxed. This means that any profit you make can be reinvested without the worry of future tax implications or diminishing returns. Moreover, TFSAs offer flexibility in terms of withdrawals. You can withdraw funds from your TFSA at any time without penalty.

In order to take full advantage of TFSAs, consider utilizing your annual contribution limit effectively. By investing the maximum allowable amount each year, you can enjoy tax-free growth while building a strong and diversified investment portfolio. It’s important to stay within the contribution limits set by the government to avoid any tax penalties.

4.2 Consider Tax-advantaged Retirement Accounts

Another tax-efficient investment strategy is to take advantage of tax-advantaged retirement accounts. These accounts, such as Registered Retirement Savings Plans (RRSPs) or 401(k)s, offer significant tax benefits that can help you build a nest egg for your future retirement while saving on taxes.

Contributions made to retirement accounts are generally tax-deductible, which means that the money you contribute is deducted from your taxable income. This reduces the amount of income tax you need to pay in the current year. Additionally, any earnings or growth within the account are tax-deferred. You only pay taxes on these amounts when you withdraw them during retirement, by which time your income and tax bracket may be lower.

By strategically allocating your investments within a tax-advantaged retirement account, you can benefit from compounding returns over the long term while simultaneously enjoying the tax advantages that these accounts offer. Moreover, some employers may contribute to these accounts on your behalf, providing an additional boost to your retirement savings.

In conclusion, by taking advantage of tax-efficient investment options such as TFSAs and retirement accounts, you can optimize your investments and minimize the impact of taxes on your wealth. These strategies provide a powerful toolset to grow your money strategically and protect your financial future.

5. Manage Risk Effectively

Managing risk is a crucial aspect of any investment strategy. By minimizing potential losses, investors can protect their capital and increase their chances of generating profits. Here are two key tactics to help manage risk effectively:

5.1 Set Realistic Investment Goals

When it comes to investing, setting realistic goals is fundamental. Begin by evaluating your financial situation and determining how much you can comfortably invest. Consider factors such as your income, expenses, and savings. Then, establish achievable targets for your investments, taking into account the timeframe and level of risk you are willing to bear.

| Investment Goal | Timeframe | Risk Tolerance |

|---|---|---|

| Short-term gains | Less than 1 year | Low to moderate risk |

| Long-term wealth accumulation | 5+ years | Moderate to high risk |

| Retirement savings | 10+ years | Moderate to high risk |

5.2 Use Stop Loss Orders To Limit Losses

Stop loss orders are another valuable tool for managing risk. These orders automatically sell a security when it reaches a pre-determined price, preventing further losses. By setting a stop loss order, investors can protect themselves from dramatic drops in market value.

For example, let’s say you purchase shares of a stock at $50 per share. To limit potential losses, you set a stop loss order at $45. If the stock price drops to $45 or below, your shares will be sold automatically, reducing your losses.

- Stop loss orders are particularly useful for high-risk investments or during periods of market volatility.

- It’s important to determine your risk tolerance and set the stop loss price accordingly, ensuring you protect your investments without being too conservative.

- Remember, stop loss orders are not foolproof. In fast-moving markets, the execution of your order may not be at the exact price specified. Hence, regularly monitor your investments and adjust your stop loss orders when necessary.

By setting realistic investment goals and utilizing stop loss orders, you can effectively manage risk and safeguard your investments. This will provide you with greater confidence and peace of mind as you navigate the dynamic world of investing.

Credit: sproutsocial.com

Frequently Asked Questions For Top 10 Investment Tricks

Q: What Are Some Investment Tricks For Beginners?

A: Some investment tricks for beginners include diversifying your portfolio, setting clear financial goals, and seeking professional advice.

Q: How Can I Minimize Risk While Investing?

A: To minimize risk while investing, consider diversifying your portfolio, investing for the long term, and doing thorough research before making any investment decisions.

Q: What Are The Best Investment Strategies For Maximum Returns?

A: The best investment strategies for maximum returns include investing in a mix of stocks and bonds, considering index funds, and regularly reviewing and adjusting your investments based on market conditions.

Q: Is It Wise To Invest All My Savings In One Investment Option?

A: No, it is not wise to invest all your savings in one investment option. Diversifying your portfolio helps reduce risk and increases the chances of achieving your financial goals.

Conclusion

These investment tricks can greatly contribute to your financial success. By diversifying your portfolio, conducting thorough research, and staying informed about market trends, you can make smarter investment decisions. Remember to set realistic goals and remain patient, as investments generally yield long-term benefits.

Don’t hesitate to seek advice from financial experts and stay proactive in monitoring your investments. With these strategies, you are well on your way to achieving your financial goals. Happy investing!