To ask your bank to waive an overdraft fee, contact customer service and politely explain the situation, providing any supporting evidence. It’s important to be respectful and clear in your communication to increase the chances of a positive outcome.

Navigating banking and financial matters can sometimes be a challenge, especially when facing unexpected overdraft fees. Many consumers may find themselves in this situation, but there are steps one can take to address it. Being proactive and knowing how to approach the bank to request a fee waiver can make a significant difference in the final outcome.

In the following sections, we will discuss the most effective ways to ask your bank to waive an overdraft fee, providing you with the best chance of success in resolving this issue.

Table of Contents

Understanding Overdraft Fees

What Are Overdraft Fees?

Overdraft fees are charges imposed by banks when a customer spends more money than is available in their checking account. This can occur when making a purchase, writing a check, or initiating an automatic payment that exceeds the account balance. Overdraft fees can vary depending on the financial institution, but they typically range from $25 to $40 per transaction.

Why Do Banks Charge Overdraft Fees?

Banks charge overdraft fees as a means of generating revenue and covering the costs associated with processing transactions that result in a negative account balance. These fees can be a significant source of income for financial institutions. While some banks may allow a small overdraft for a fee, others may deny the transaction altogether.

The Impact Of Overdraft Fees On Your Finances

Overdraft fees can have a detrimental effect on your finances, potentially leading to a cycle of debt and financial hardship. These fees can accumulate quickly, especially if multiple transactions result in overdrafts. Additionally, if the negative balance is not promptly resolved, it can impact your credit score and result in additional fees and penalties.

Credit: www.self.inc

Knowing Your Bank’s Policies

Reviewing Your Bank Account Terms And Conditions

Before approaching your bank to waive an overdraft fee, it’s essential to familiarize yourself with their terms and conditions. These can typically be found on the bank’s website or provided upon account opening. Reviewing it will give you valuable insights into what fees the bank charges for overdrafts, as well as the procedures for disputing them. Be thorough to understand all the fine print and clauses that may apply to your situation.

Understanding Your Bank’s Overdraft Fee Policy

Having a clear understanding of your bank’s overdraft fee policy is crucial before making any requests. This information may specify the amount of the fee, under what circumstances it’s applied, and any grace periods provided. Familiarize yourself with the specific details surrounding overdrafts to build a strong case during your request for a waiver. Being knowledgeable about your bank’s policies will position you as an informed and proactive customer, increasing the likelihood of a favorable outcome.

Preparing To Request A Fee Waiver

Learn how to effectively request a fee waiver from your bank for an overdraft fee. Discover the steps and techniques to increase your chances of success.

Gather Necessary Documents And Information

Before approaching your bank to request a fee waiver for an overdraft fee, it is important to gather all the necessary documents and information to support your case. This will not only provide a strong foundation for your request, but it will also demonstrate to the bank that you have taken the time to thoroughly prepare and are serious about resolving the issue. Here are some key documents and information you should collect:

- Bank statements: Retrieve your recent bank statements that show the overdraft fee in question. This will serve as concrete evidence of the fee, allowing the bank to easily verify the details.

- Transaction records: Compile a list of your recent transactions to get an overview of your account activity. This will help you evaluate your account history and identify any valid reasons for requesting a fee waiver.

- Proof of extenuating circumstances: If you experienced any unforeseen or extraordinary circumstances that led to the overdraft, such as a medical emergency or a sudden loss of income, gather any relevant documentation or evidence to support your claim. This could include medical bills, termination letters, or any other official documents that prove your situation.

- Contact information: Have your bank’s contact information readily available, including the customer service phone number and email address. Having this information at your fingertips will make it easier for you to promptly reach out to the bank and initiate communication about the fee waiver.

Evaluate Your Account History

As you prepare to request a fee waiver, it is essential to evaluate your account history. By thoroughly reviewing your recent transactions and account activity, you will gain valuable insights that can help you present a compelling case to your bank. Here are some factors to consider:

- Frequency of overdrafts: Take note of how often you have encountered overdraft fees in the past. If this is an isolated incident and you have a history of maintaining a positive account balance, it may strengthen your argument for a fee waiver.

- Positive account balance: If there have been instances where your account has had a sufficient balance to cover the overdraft, highlight these periods. This will demonstrate that you are typically responsible with your finances and that the fee occurrence is an exception rather than a recurring problem.

- Banking relationship: Consider your overall relationship with the bank. If you have been a loyal customer with a long-standing account, it may work in your favor when requesting a fee waiver. Banks often value customer retention and may be more inclined to accommodate your request if you have a strong relationship with them.

Identify Valid Reasons For Requesting A Fee Waiver

When preparing to ask your bank to waive an overdraft fee, it is crucial to identify valid reasons that align with the bank’s policies and guidelines. By highlighting compelling justifications, you increase your chances of a successful fee waiver. Here are some valid reasons to consider:

- Banking error: If you believe the overdraft fee was a result of a banking error, such as a delayed deposit or a miscalculation, gather any supporting evidence to prove your claim. This could include receipts, transaction records, or communication with the bank.

- Dire financial circumstances: If you are facing significant financial difficulties and the overdraft fee exacerbates your situation, explain your circumstances to the bank. Provide supporting documentation, such as income statements, unemployment records, or proof of unexpected expenses.

- Notification issues: If you did not receive timely notifications or alerts from the bank regarding insufficient funds, highlight this as a reason for the fee waiver. Gather any evidence, such as previous notification records or communication with the bank’s customer service.

Credit: www.bankrate.com

Crafting Your Request

When it comes to asking your bank to waive an overdraft fee, crafting a well-written request is crucial. Writing a formal letter or email to your bank, explaining the situation clearly, and presenting a valid case for the fee waiver are the key steps to include in your request. Let’s delve into each one:

Writing A Formal Letter Or Email To Your Bank

When addressing your bank, it’s important to maintain a professional tone. A well-structured letter or email can make a positive impression and increase the chances of your request being considered. Here’s an example of how you can format your letter:

| Your Name | Your Address | City, State, Zip Code |

| Date | Bank Name | Bank Address |

| Dear [Bank Representative’s Name], | ||

| Introductory paragraph: Briefly explain the purpose of your letter. | ||

| Body paragraphs: Clearly state the details of your situation and why you are requesting the fee waiver. Use bullet points or an ordered list to make your points concise and easy to understand. | ||

| Closing paragraph: Express your appreciation for their time and consideration. Provide your contact information and invite them to reach out to you for any further information. | ||

| Sincerely, | ||

| Your Name |

Explaining The Situation Clearly

When explaining the situation that led to your overdraft fee, it’s important to be concise and to the point. Start by stating the date and amount of the transaction that caused the overdraft. Clearly explain any extenuating circumstances that were beyond your control and led to the overdraft. For example:

On [date], a large unexpected expense of [amount] unexpectedly debited my account, causing an overdraft. This expense was due to a medical emergency that required immediate attention and left me with no other choice but to use my available funds.

Presenting A Valid Case For The Fee Waiver

Your bank will consider waiving the overdraft fee if you present a valid case that demonstrates your financial responsibility and trustworthy banking history. Here are some key points to include:

- Highlight your positive banking history, such as a long-standing relationship with the bank and a consistent record of timely payments.

- Mention any previous instances where your bank has waived similar fees, showcasing that you are a valued customer.

- Explain how the overdraft fee is disproportionate to the amount overdrawn and how it adds a significant burden to your financial situation.

- Offer a resolution, such as setting up alerts or automatic transfers to prevent future overdrafts.

By providing a compelling case for the fee waiver, you increase your chances of a positive response from your bank.

Engaging With Your Bank

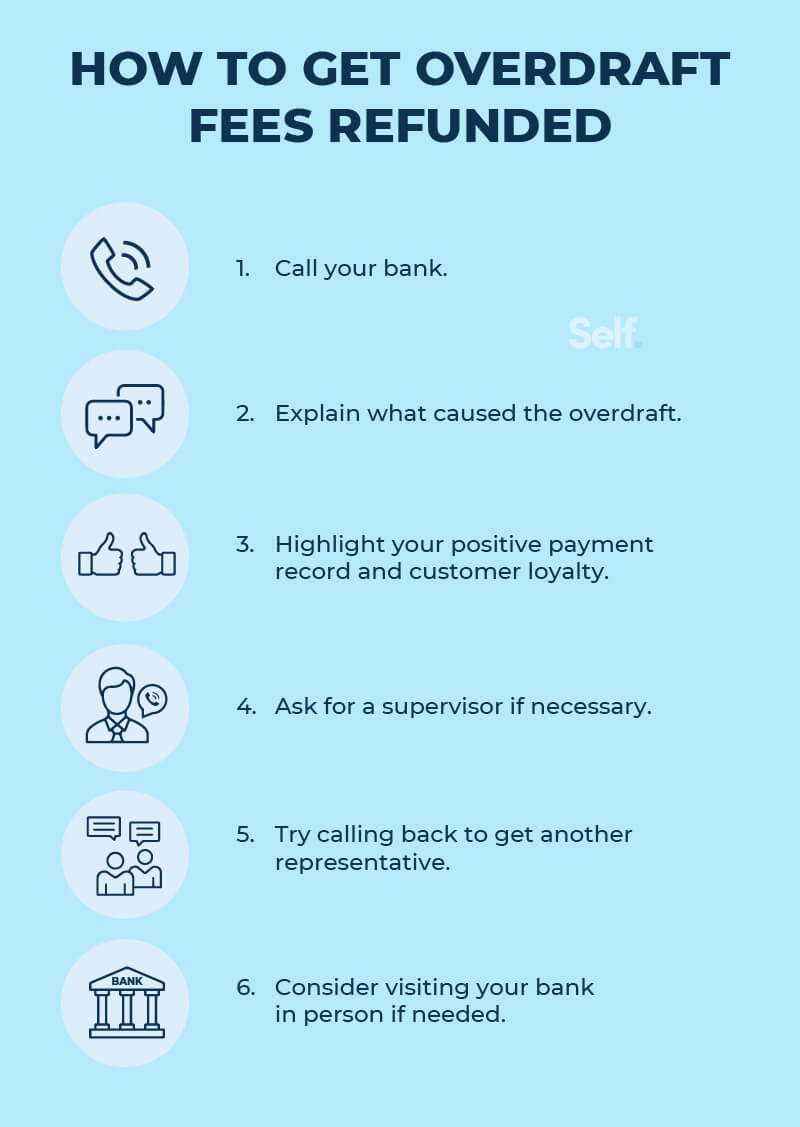

When it comes to dealing with overdraft fees, engaging with your bank is crucial. By effectively communicating with your bank, you can increase your chances of having the overdraft fee waived. In this section, we will discuss three ways to engage with your bank: calling customer service, speaking to a bank representative in-person, and negotiating with the bank.

Calling Customer Service

If you prefer a quick and convenient option, calling customer service is a great way to engage with your bank. Follow these simple steps to maximize your chances of success:

- Prepare beforehand: Before making the call, gather all the necessary documents and information related to your account and the specific overdraft fee.

- Be polite and stay calm: Remember to stay composed and polite while speaking with the customer service representative. A friendly approach can go a long way in conveying your concerns effectively.

- Explain the situation clearly: Clearly state the reason for your call and provide details about the circumstances leading to the overdraft fee. Emphasize any extenuating circumstances that may have contributed to the fee.

- Propose a solution: Offer a reasonable suggestion or request to have the overdraft fee waived. You could mention your loyalty as a long-standing customer or your prompt action to rectify the situation.

- Take notes: Throughout the conversation, make sure to jot down important points, such as the representative’s name, the date and time of the call, and any promises made by the bank. These details can be useful for future reference.

Speaking To A Bank Representative In-person

If you prefer a more personal approach, speaking to a bank representative in-person can be effective. Follow these steps to make the most of your face-to-face interaction:

- Schedule an appointment (if necessary): To ensure that you can meet with a bank representative without any inconvenience, call ahead to schedule an appointment.

- Dress appropriately: Dress in smart casual attire to make a good impression during your visit to the bank.

- Provide necessary documents: Bring all relevant documents, such as account statements and proof of extenuating circumstances, to support your case.

- Express your concerns clearly: Clearly explain the situation and express your concerns about the overdraft fee. Use a confident and assertive tone to highlight the importance of this matter to you.

- Be prepared to negotiate: Be open to negotiation and propose a mutually agreeable solution that involves waiving or reducing the overdraft fee.

Negotiating With The Bank

In some cases, negotiating with the bank may be necessary to reach a resolution. Follow these steps to effectively negotiate:

- Stay confident and assertive: Approach the negotiation with confidence and maintain a polite yet assertive demeanor.

- Highlight your relationship with the bank: Emphasize your loyalty, long-standing relationship, and positive banking history to demonstrate your value as a customer.

- Present evidence: If applicable, provide any evidence that supports your request to have the overdraft fee waived, such as account activity or extenuating circumstances.

- Suggest alternatives: Propose alternative solutions, such as enrolling in overdraft protection or setting up automatic alerts for low balances, to avoid future fees.

- Be patient: Negotiations may take time, so remain patient and persistent in pursuing a resolution that benefits both parties.

Credit: www.self.inc

Frequently Asked Questions Of How To Ask Your Bank To Waive An Overdraft Fee

How Can I Ask My Bank To Waive An Overdraft Fee?

To ask your bank to waive an overdraft fee, contact their customer service or visit a branch. Be polite and explain your situation clearly, emphasizing your good account history. It’s also helpful to mention any extenuating circumstances that caused the overdraft.

Remember to be persistent but respectful in your request.

Is It Possible To Negotiate With My Bank Regarding Overdraft Fees?

Yes, it’s possible to negotiate with your bank regarding overdraft fees. Start by contacting their customer service and explaining your situation. Be honest and provide any supporting documentation if necessary. If the first representative denies your request, try speaking to a supervisor or escalating your complaint to increase your chances of success.

What Are Some Tips To Increase My Chances Of Getting An Overdraft Fee Waived?

To increase your chances of getting an overdraft fee waived, follow these tips: 1. Contact your bank as soon as the fee is applied. 2. Explain your situation clearly and honestly. 3. Highlight your good account history and any extenuating circumstances.

4. Be polite and persistent, escalating your complaint if necessary. 5. Consider switching banks if your current one is not flexible with fees.

Conclusion

Asking your bank to waive an overdraft fee doesn’t have to be a daunting task. By following the steps outlined in this blog post, you can confidently approach your bank and make a compelling case for fee reversal. Remember to remain calm, provide supporting evidence, and emphasize your loyalty as a customer.

With a well-prepared approach, you increase your chances of success and potentially save money in the process. Start taking action today and see the impact it can have on your financial well-being.